July’s 15% Swift Transaction Drop Meets XRP’s ETF-Fueled Breakout — Is This the Tipping Point for Cross-Border Payments?

In the fast-changing world of global finance, few things turn heads faster than a sudden shift in payment systems. July 2025 saw a 15% month-over-month Swift Transaction Drop — and now, as of October, XRP has rallied over 20% on ETF inflows and CME options launches, reigniting the cross-border payments debate.

Let us unpack what is really happening — and why this is not just another crypto headline.

Swift: The Backbone That’s Showing Cracks

As you all know, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) has always been transparent with international money transfers.

More than 11,000 financial institutions across over 200 countries depends on Swift for secure communication when sending significant amounts of money every single day.

But July 2025 financial reports confirmed a 15% month-over-month Swift Transaction Drop, especially in high-value payments — while XRPL volumes surged triple-digit in key remittance corridors. While Swift still dominates, the slowdown signals something deeper — a shift in trust, speed, and cost efficiency in global banking.

And that is where XRP, Ripple’s native token, takes the stand.

XRP Steps Into the Spotlight

Ripple has long positioned itself as the modern alternative to Swift, offering what banks have been craving for years — instant, low-cost global transactions without the traditional delays.

When Swift volumes started to dip, investors and analysts didn’t waste time connecting the dots. Momentum built into October, when XRP rallied over 20% in a week — driven by $61.6M in ETF inflows and CME’s XRP options launch.

So, what is the reason which is fueling this surge?

Three main factors stand out:

- Efficiency Advantage – While Swift transactions can take up to three days, XRP transactions often settle in just 3–5 seconds.

- Lower Fees – International transfers using RippleNet cost a fraction of the traditional wire fees.

- Bank Partnerships – Ripple continues to expand partnerships with banks and fintech companies in Asia, the Middle East, and Latin America. These are the regions where Swift dominance has been slipping. Over 300 institutions now use RippleNet, processing $1.3T in H1 2025 — up 53% YoY.

Why the Swift Decline Matters

To understand why Swift’s dip is so important, let’s draw a simple analogy.

Think of Swift as the postal service of money transfers — reliable but slow. Now imagine XRP as email for money — fast, global, and borderless.

As businesses and consumers get used to instant everything, from messaging to shopping, waiting three days for a bank transfer suddenly feels outdated.

Swift has made efforts to modernize with its gpi (Global Payments Innovation) system, but it still struggles to match Ripple’s blockchain efficiency. The market is noticing — and so are investors.

Global Ripple Effects: Beyond the Price Surge

XRP’s recent rally isn’t just about speculation. It’s a reflection of growing confidence in blockchain-based financial infrastructure.

Several recent developments back this up:

- Asian and Middle Eastern Banks Lead Adoption: Financial institutions in Japan, Singapore, and the UAE are increasingly testing RippleNet as an alternative to Swift’s cross-border framework.

- Regulatory Clarity in the U.S.: Following Ripple’s partial legal victory against the SEC, confidence in XRP as a legitimate digital asset has strengthened.

- Institutional Interest: Hedge funds and payment providers are exploring XRP not as a “crypto bet” but as a utility asset with real-world use cases.

In short, XRP’s rise isn’t just a market blip — it’s a signal of changing tides in the financial world.

Investors Smell Opportunity

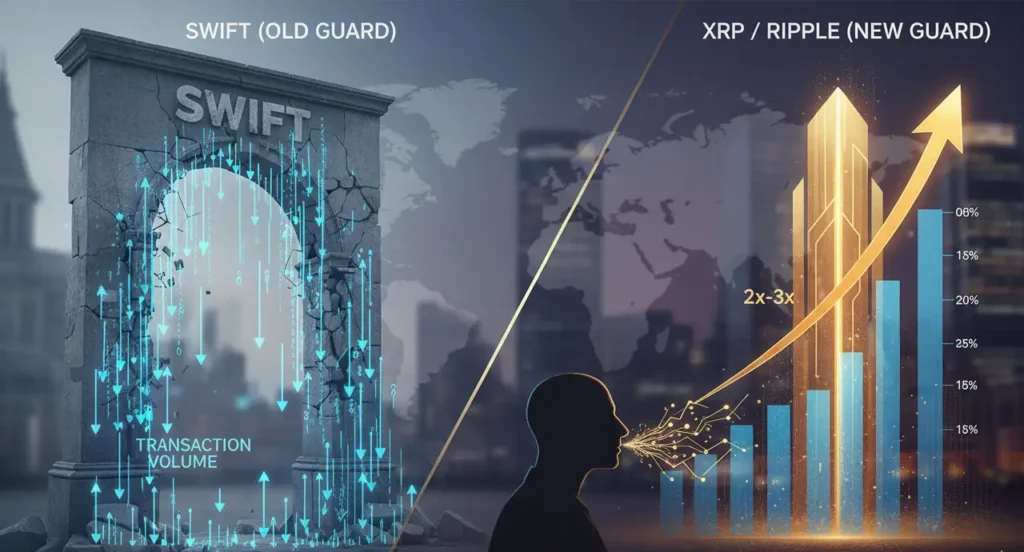

The crypto market runs on narratives, and right now, XRP has a powerful one: the old guard (Swift) vs. the new guard (Ripple).

Traders see Ripple’s growing adoption as a sign of long-term potential.

At the same time, Swift’s decline has raised eyebrows — if even a small percentage of its global transaction volume moves toward blockchain-based systems, the impact could be enormous.

Ripple CEO Brad Garlinghouse (Apex 2025) forecasts 14% capture of SWIFT volume in 5 years — enough to 2x–3x XRP from current levels.

Of course, predictions aside, what’s certain is this: Ripple is no longer just a disruptor; it’s becoming part of the infrastructure conversation.

Swift Isn’t Out of the Game Yet

Let’s be fair — Swift isn’t going anywhere overnight.

The network still moves over $150 trillion annually, and it remains the gold standard for institutional security and compliance. However, it’s facing the same challenge every legacy system eventually does — adapt or risk irrelevance.

Swift’s latest initiatives — like experimenting with CBDC (Central Bank Digital Currency) interoperability — show it’s aware of the pressure to prevent Swift Transaction Drop. But whether these upgrades arrive fast enough to compete with blockchain speed remains the billion-dollar question.

The Real Battle: Trust and Transition

At its core, this isn’t just about technology. It’s about trust.

Banks and governments have spent decades relying on Swift’s stable, regulated network. Transitioning to a blockchain model like Ripple’s involves rethinking everything — from compliance frameworks to liquidity management.

Yet, as we’ve seen in technology again and again (from emails replacing letters to streaming replacing DVDs), once efficiency meets reliability, change becomes inevitable.

Ripple is betting that its blend of speed, transparency, and cost-effectiveness will eventually win that trust.

What It Means for the Future of Payments

If the trend continues — Swift Transaction Drop and XRP’s rise — we could be watching the beginning of a payment revolution.

Here’s what the next few years might look like:

- Hybrid Systems: Banks using both Swift and blockchain networks for different transaction types.

- More CBDC Integration: Ripple’s infrastructure could become the bridge between digital currencies and traditional finance.

- Faster Remittances: People who are sending their money internationally will experience quick settlements in the future.

It will take time, but the path for Future payments is set. The future of finance belongs to systems that move money faster, cost less, and work for everyone.

Data as of October 25, 2025. Prices are volatile. Always DYOR.

Final Takeaway: A Changing of the Guard

The Swift Transaction Drop in volumes and the surge in XRP are more than just parallel headlines — they’re signs of transformation.

We’re witnessing a world slowly pivoting from legacy infrastructure to blockchain-based innovation. Swift built the backbone of global payments, but Ripple and XRP are redefining what that backbone could look like in a digital-first economy.

As markets evolve, the winners will be those who adapt fastest — and right now, XRP seems to be sprinting ahead.

Interested in how blockchain continues to reshape industries? Explore more stories in our AI in Finance